Financial report analysis

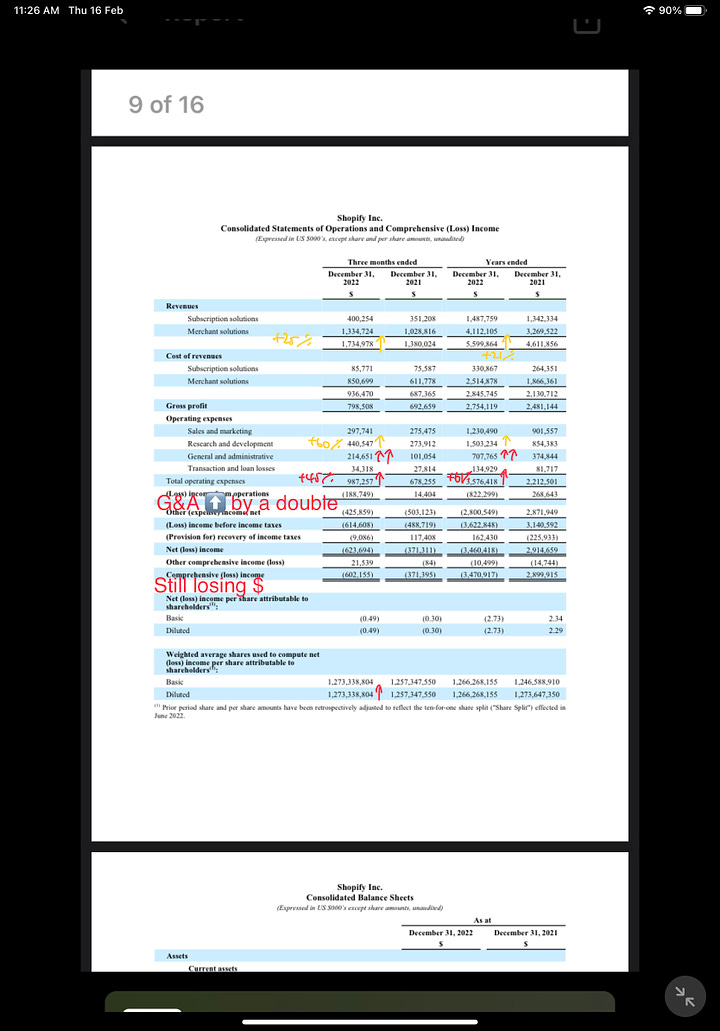

💩Terrible income statement!

❗️GPM YoY ⬇️

🚩G&A expense increase by a double!

R&D increased by 60% still acceptable, given lots of new products were rolling out in FY2022

✅ OPEX growth to continue to slow

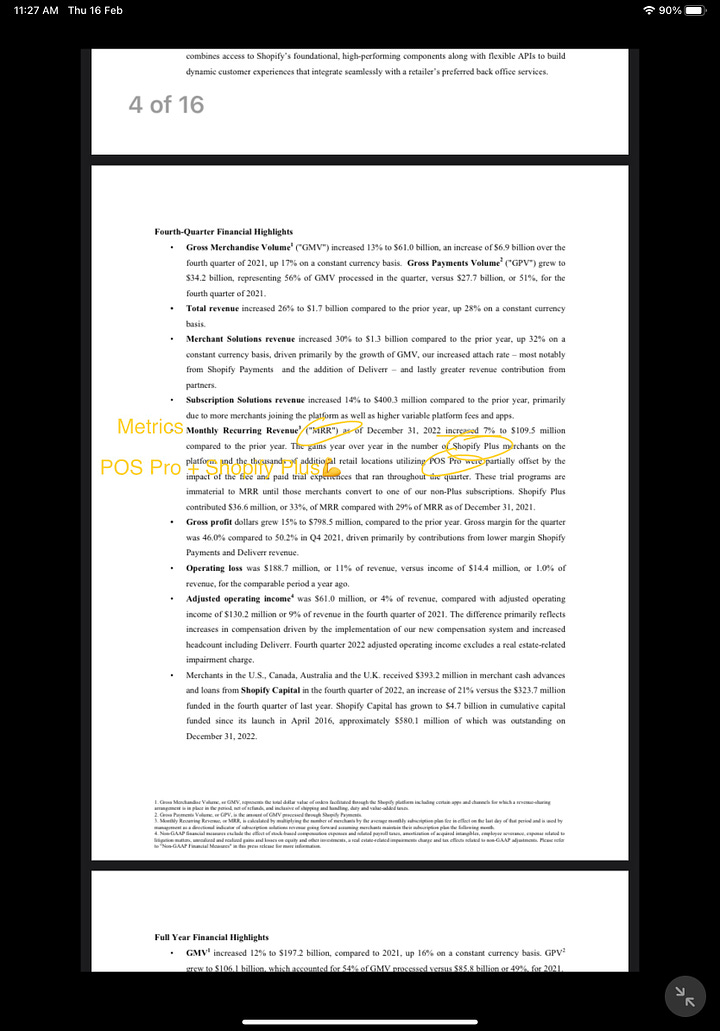

POS Pro & Shopify Plus are 2 key products for the year

POS supports retailers with up to 1K locations. Offline GMV +40% YoY in 2022.

Earnings Transcript Key Takeaways

Roll out lots of new products, imply 💩huge cost incurred last year

2022FY year had 2 themes

Go global: 45% of its merchants now based outside of North America generating 27% of revenue. Shopify Payments is now available in 22 countries; Point-of-Sale in 14 countries, Shipping in 7 countries and Shopify Capital in 4 countries.

Enterprise merchants

Merchant solution revenue is the heart of Shopify

Merchant solution revenue +30% was❗️inflated by Deliverr M&A contribution

❗️Merchant Solution's gross margin continues to decline, primarily due to lower margin business from Deliverr.

The attach rate showed +ve growth still

🚩SBC increased by 66%

✅ Recent plan price increased in Q4 (Shopify Plus plan remains unchanged)

❗️BUT overall margin will not increase because

Merchant solution grow at higher speed

Management is looking for QoQ stabilisation in GPM

Shop App enhancement, including discounts and expanded search function, personalized shopping experiences and embedding Shop Cash, loyalty program that is currently in early access in 22FY.

A key feature of the Shop App is ⭐️Shop Pay, our accelerated checkout feature that continues to commerce better for merchants and buyers alike.

Shop Pay were doing good in 2022FY, accelerated checkout facilitated $11 billion in GMV in Q4 and a cumulative $77 billion at vear-end since its launch in 2017.

Shopify Payment penetration increased from 19Q1 41% to 22Q4 56%

Earnings Transcript Extract

Business philosophies

Shopify wants to be the go-to platform for everyone who wants to start a business. He acknowledged that not every merchant will be successful, but those who are will stay with Shopify indefinitely and take more and more of the company's merchant solutions.

Shopify is increasingly the go-to platform for celebrities and creators, such as Pharrell and Logan Paul, to launch their brands, and it has powered pop-up stores for brands like SKKN and M&M's moms spaghetti.

Shopify enables its merchants to go from first sale to full scale: Shopify continues to enhance and build new tools to simplify and support merchants' journeys for every stage of growth.

✅ Enterprise merchants

Shopify introduced its enterprise retail solution, Commerce Components by Shopify (CCS, retailers can choose the Shopify components they want, integrate with their existing systems), and updated subscription prices on its Basic, Shopify, and Advanced plans.

Why Shopify?: Commerce components allow large merchants to use the best parts of Shopify, such as the checkout, shipping infrastructure, and data and compliance, and combine them with the things they already have in-house. This creates flexibility and future-proofs their business.

Large-scale businesses, such as Giant Tiger, Bauer Hockey, Black and Decker, and Mattel, to its client base. It has also expanded into new international markets and welcomed luxury brands like Sergio Rossi and Bally to its platform.

Shopify Plus, continues to do well, with merchants upgrading automatically from Shopify's core product and other brands leaving existing platforms for Shopify Plus.

✅ International selling

Shopify Markets and Markets Pro were launched to lower the barriers for Shopify's merchants to sell globally.

Shopify enables cross-border sales. With capabilities such as local currency, language translations, payment methods, and an import duties calculator, Shopify is making selling internationally as easy as selling locally. Shopify's latest addition to its merchant's global toolkit, Markets Pro, has ✅ improved cross-border conversion by up to 36%.

In 2022, approximately 45% of Shopify's merchants were based outside of North America, making up approximately 27% of its revenue. To support its global expansion,

New Products

Shopify's new products and enhancements to existing products in 2022 were significant, with launches like Shopify Audiences, Shopify Collabs, POS Go, Tap to Pay, and integrated Twitter Shopping and YouTube channels.

Shopify's point-of-sale (POS) Pro solution continues to gain traction with brands of all sizes, with Plus merchants accounting for approximately 27% of all point-of-sale Pro sales.

Shopify's Point-of-Sale Go, its first-in-class mobile hardware device, takes the merchant and customer experience to the next level by offering buyers of super quick checkout.

Shopify made it easier for businesses worldwide to go from first sale to full scale on their platform by providing Shopify Functions, Hydrogen and Oxygen, and expanded back-office merchant solutions to more countries to allow greater customization.

Shopify launched Shopify Tax, a new product offered to U.S.-based merchants that simplifies tax compliance and takes the stress out of sales.

Shopify launched Shop Promise, a consumer-facing badge that provides reliable and accurate delivery dates across the merchant’s online store, check out and on the shop app, to improve store conversion. Merchants in the program have seen up to 25% increase in conversion rates.

Payment

✅ Shopify Pay

About 100 million buyers have opted-in into Shop Pay, and that it has seen about $11 billion in GMV go through Shop Pay in Q4 alone, with a cumulative total of about $77 billion since its launch in 2017.

Shop Pay accelerated checkout button's penetration gain, which is now approaching about 20% of GMV.

Shopify rolled out Shop Pay on YouTube in Q3 of 2022.

Shop Pay GMV increased 43% year-on-year in Q4.

Relationship with Amazon

Shopify has a long history of partnering with technology companies, such as PayPal, to help its merchants sell more.

Buy with Prime is going to make its infrastructure available to merchants to sell more.

Shopify thinks it's important for merchants to have a relationship with their end consumer, and any integration with Buy with Prime has to be done in a way that maintains that relationship.

Other products

Shopify Capital has acted as a lifeline for merchants, allowing them to conveniently access capital when they need it most. The company's machine learning algorithms to underwrite merchants keep getting better. In Q4, Shopify advanced nearly $400 million, up 21% from the same period last year, bringing the cumulative amount since it launched Shopify Capital in 2016 to nearly $4.7 billion.

The rollout of free and paid trial

Launched a start-up plan in June 2022, which replaced the existing life plan, to make it easier for aspiring entrepreneurs to get started on Shopify and test their product market fit.

Allow Shopify to get more merchants trying and playing with Shopify.

Metrics

Attach rate: almost 2.85% this year relative to 2.55% last year. This rate is a proxy for the value and the amount of services and products the company's merchants use.

Financials

Revenue for the fourth quarter grew to $1.7 billion, 26% YoY growth, or 28% in constant currency, the highest growth rate of any quarter in 2022, driven by strong merchant solutions growth.

The merchants' GMV grew to $61 billion, up 13% YoY or 17% in constant currency basis, outpacing overall U.S. retail growth of 6%, and the strong Black Friday Cyber Monday was a key driver of this Q4 GMV outperformance.

Merchant solutions vs Subscription solutions

Merchant solutions revenue was $1.3 billion, ✅ increasing 30% YoY or 32% on a constant currency basis, primarily due to the increase in GMV, a higher penetration of Shopify Payments, and the contribution from Deliverr.

Subscription solutions revenue was $400 million, up 14% YoY, driven primarily by an increase in the number of plus subscriptions, higher variable platform fees from plus merchants, and the higher revenue shares from ecosystem app developers.

Gross profit was up 15% to $799 million, and gross margin was 46% for the quarter, and 🚩stock-based compensation for Q4 was $142 million compared to $98 million for the same period a year ago, primarily driven by Deliverr and higher headcount.

OPEX: Q4 versus Q3 was essentially flat in terms of operating expenses when you pull out the one-time charges related to real estate, legal, and severance.